This article is based on a presentation given by Dominic at the Customer Success Festival in Las Vegas, in May 2023.

Catch up on this presentation, and others, using our OnDemand service. For more exclusive content, visit your membership dashboard.

The technology investment landscape is changing. There’s a shift from an intense growth-focused climate, marked by a fear of missing out, to the current state of heightened scrutiny and accountability, FOMU – fear of messing up.

I'm Dominic Constandi, the Chief Customer Officer at ZoomInfo. If you aren't familiar with us, we primarily offer go-to-market intelligence. Although many people think of us as a data company, we offer way more than that.

On top of our data assets, we have a variety of platforms and solutions designed to help identify potential buyers. These solutions provide guidance on how to reach out to them, the best time to make contact, and the right person to engage within the organization.

In this article, we'll navigate the current tumultuous economic waters, and explore risk mitigation, customer management strategies, as well as the necessity of maintaining an awareness-first approach to mitigate churn.

Navigating economic compression: From FOMO to FOMU

The first point I'd like to address is how economic compression has led to increased scrutiny of technology spending and a decreased tolerance for vague returns on investment.

During 2020 and 2021, we witnessed a massive digital acceleration phase. We saw company valuations skyrocket. As an example, in July 2021, ZoomInfo purchased a company named Chorus, a player in the conversational intelligence space, akin to Gong.

We acquired Chorus for $600 million during a peak in valuations, which makes it a prime example of the changing landscape. But if we were to repeat that acquisition today, it would look quite different.

During this time of digital acceleration, there was an intense focus on growth, marked by a sense of fear of missing out (FOMO). Businesses, including major players like IBM, Amazon, and Google, were investing heavily to facilitate growth.

Many company valuations at that time were based on a multiple of revenue. The market was growing rapidly and profitability wasn't the primary concern. The main idea was to maintain growth and not lose ground against competitors. Venture capitalists were investing heavily, pushing valuations even higher.

However, as we all know, the market inevitably shifted. Interest rates rose and investment in tech diminished. The investment focus has now shifted from revenue-based valuations to profitability. The current rule of thumb is not to invest in tech unless it's profitable. So, the fear of missing out has been replaced by a new acronym – FOMU – fear of messing up.

Every dollar spent now has to generate a return, as businesses are either cutting staff or trimming their technology stack. If a company isn't utilizing a purchased product to its full extent, it becomes a problem. There's no more tolerance for wastage, no acceptance of unused licenses, or under-utilized resources.

In customer success, our new focus is on mitigating this downside pressure. We're identifying risks, creating criteria for risk assessment, and developing playbooks and strategies to help alleviate those risks.

Understanding risk mitigation: The importance of awareness in preventing churn

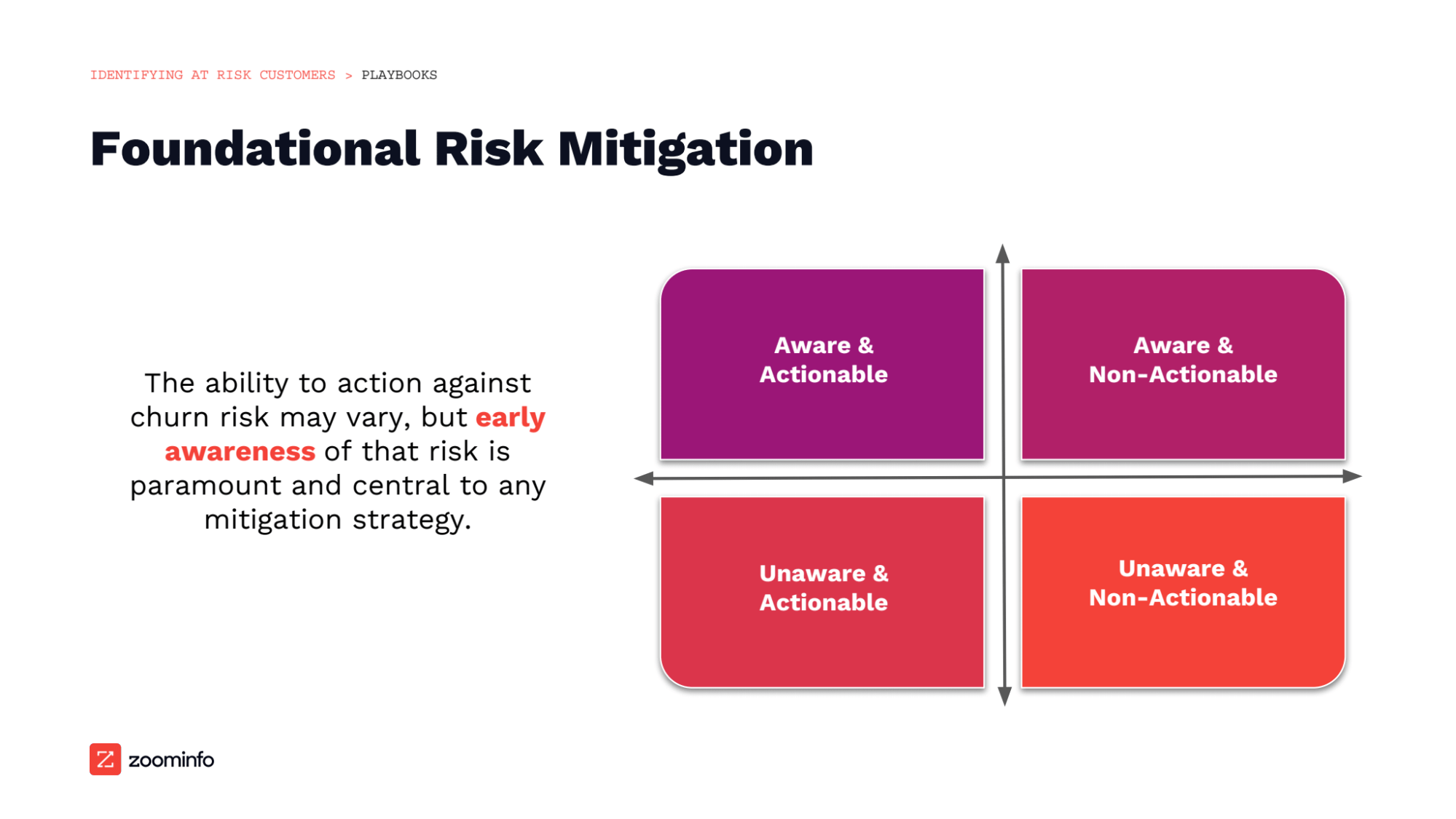

Fundamentally, when we discuss risk, we're talking about risk mitigation. To conceptualize it, I like to think in terms of quadrants.

The Y-axis represents awareness, with high awareness at the top and low awareness at the bottom. The X-axis indicates the actionability of the risk or churn threat; the right end of the axis represents non-actionable risks and the left represents highly actionable ones.

In an ideal world, when considering risks or churn threats, we want to be aware of them, and that awareness is central to any risk mitigation strategy. However, with finite resources and possibly fewer team members than before, it's impossible to mitigate all risks. Automating as much as possible can help free up time, but remember that not all risks are created equal.

If I were to plot all the significant churn threats we face in a year, I’d want most of them to be in the top-right quadrant of our graph. Being highly aware of a churn risk, even if it's non-actionable, means I can do something about it. There's nothing worse than being blindsided by a churn threat due to unnoticed poor utilization or bad adoption, especially when it's too late to change the outcome.

However, if a customer does churn despite our best efforts and we're fully aware of it, it's easier to accept. These are scenarios where there was nothing we could have done, such as the customer being acquired or a major reshuffling in their team.

What's more damaging and potentially disastrous for a business is the churn in the bottom-left quadrant of our graph. This represents churn that could have been prevented with early warning signals, the right metrics, the right KPIs, and the right operational rigor, providing a robust risk management framework. This type of churn can sink businesses. If we'd been aware of it, we could have taken action to prevent it.

So, the central focus in risk mitigation is awareness. Whether a situation is actionable may vary, but if we are aware, we can make the second decision for ourselves.

Shifting the focus: From features to use cases for effective customer management

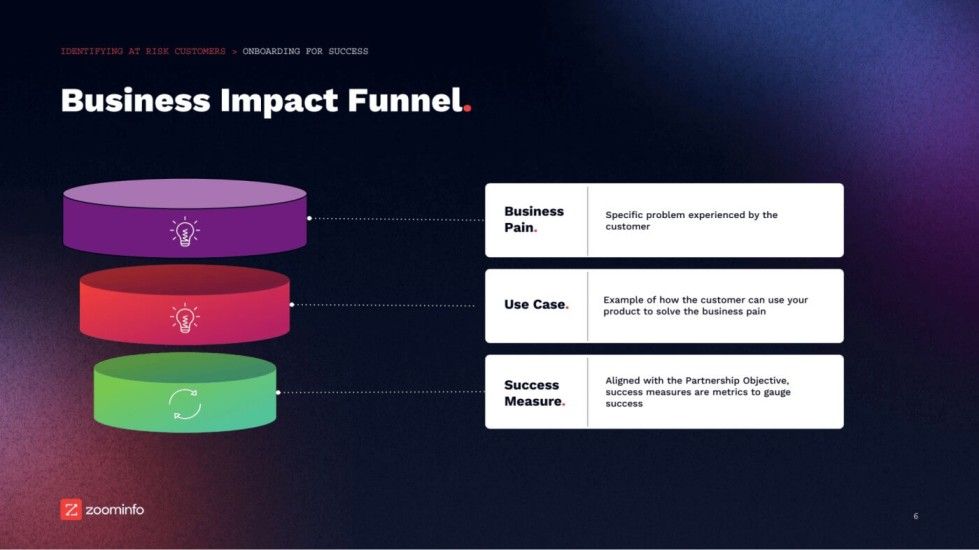

The process of understanding and addressing a customer's needs involves several stages. Firstly, you identify the business pain your customer is experiencing. By understanding this pain, you can pinpoint the specific problems that need to be solved, which in turn allows you to create a relevant use case.

A common mistake I often see is an over-emphasis on features rather than on the use case. It's easy to get excited about a multitude of features, such as specific buttons that trigger certain actions. However, they won't provide much value if these features don't address the customer's specific use case.

The key here is to shift the mindset from being feature-focused to being use case-focused. A use case is essentially a solution to the business's pain. Features simply enable the use case – they are tools to solve the problem, not the solution itself.

Once you've established the use case, you can determine what success looks like for your customer and decide what metrics you'll use to measure that success. Understanding what to measure is a critical part of this process, as it helps align your solution with the customer's goals.

In our operations at ZoomInfo, we have a particular approach to customer journey and problem-solving. Remember, this is just an example and it's shaped by various factors such as our product, customer base, resources, and technology stack. Your organization might adopt a different strategy depending on its unique circumstances.

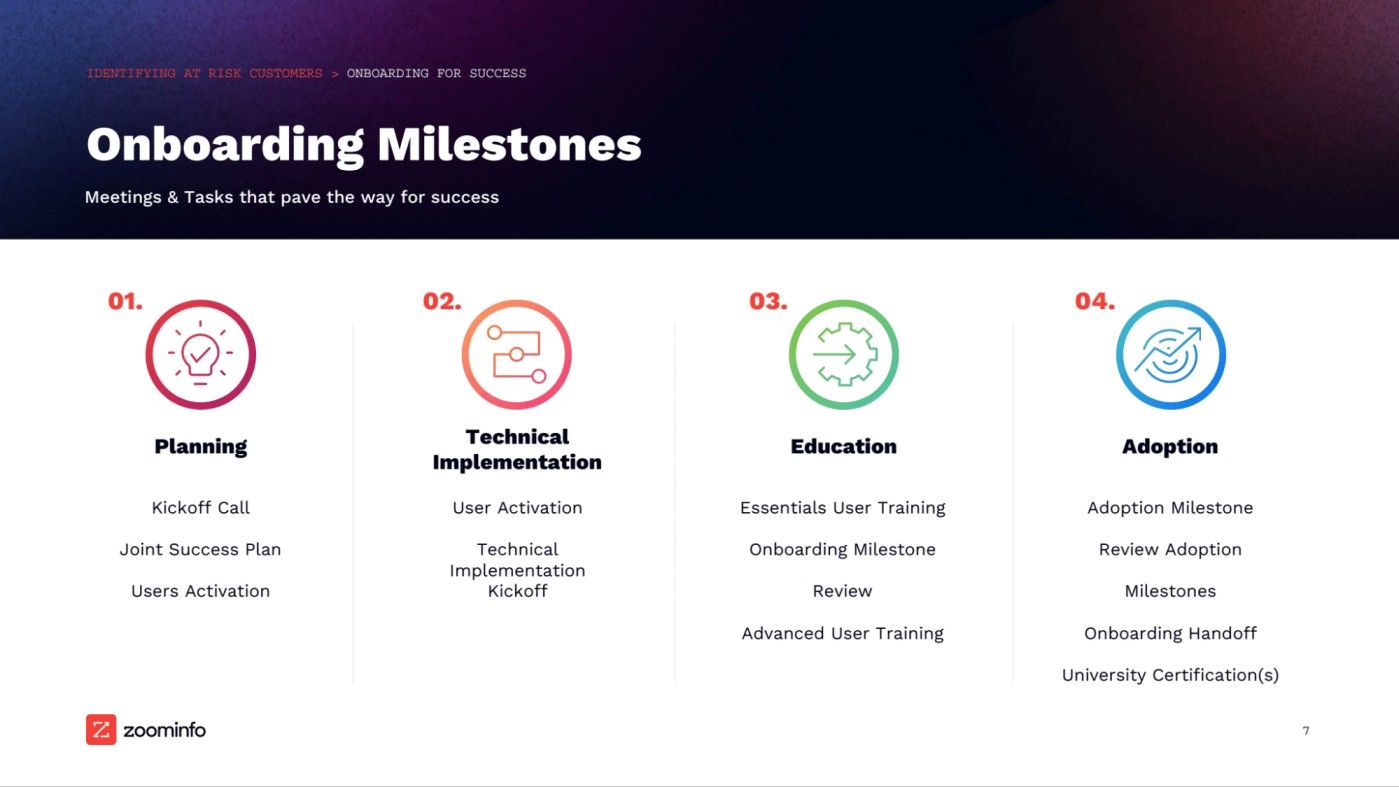

In our case, the process begins with the sales team performing the discovery phase, after which they relay the findings to the onboarding team. We've separated our onboarding team from our Customer Success Managers (CSMs), primarily as a scalability measure. The onboarding managers oversee the initial 30 to 60 days of the customer journey, which enables us to standardize, repeat, and scale our processes while measuring specific parameters.

After the initial kickoff call, a joint success plan is established based on the sales handoff. We then determine the user activation strategy and proceed to the technical implementation phase.

During onboarding, we reaffirm the business pain and the corresponding use case. The onboarding team uses this use case to guide user adoption through technical setup. After this, our training team steps in to provide education tailored to the specific use case. The training focuses on the features and functionalities that will generate the desired return on investment (ROI).

In essence, our approach involves identifying the business pain, planning the solution, implementing the technical setup, providing specific training, and finally, encouraging user adoption. This workflow allows us to effectively cater to our customer's needs and ensure their success with our product.

Navigating the customer journey: ZoomInfo’s approach to onboarding and user adoption

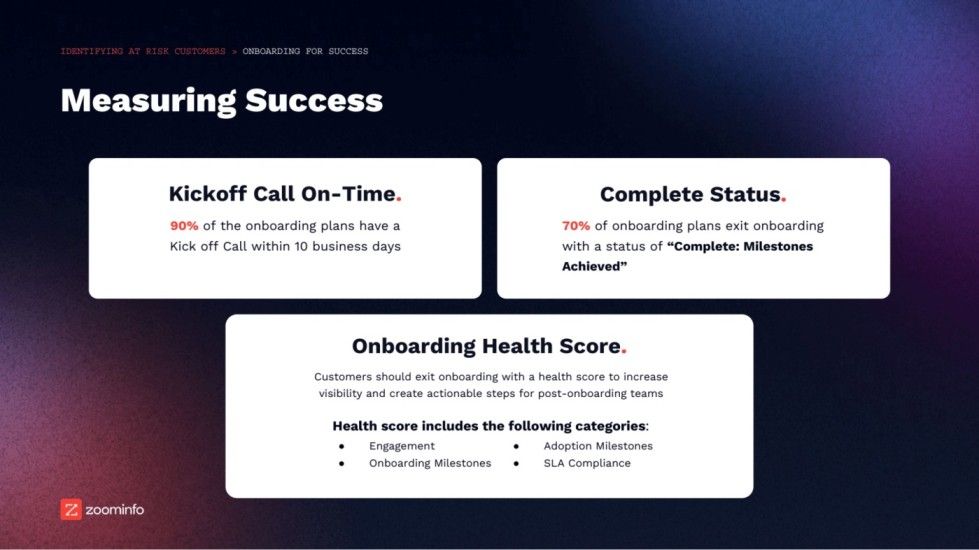

At ZoomInfo, we prioritize certain measures of success, particularly during the onboarding process. These measures allow us to monitor our performance and make necessary adjustments. These measures might be specific to us, but they give an idea of the metrics a company might focus on.

The first two measures are the number of kickoff calls made on time and the completion status. These metrics are primarily focused on our internal performance. For instance, we aim to have 90% of our onboarding plans initiate a kickoff call within the first ten business days after signing. Monitoring this metric allows us to identify potential issues in our processes, team capacity, or team engagement.

The completion status measure is used to track if 70% of the onboarding plans have reached the defined milestones. These milestones are key indicators of adoption and utilization that set the trajectory for future engagement.

The third measure, which arguably carries the most weight, is the onboarding health score. This score reflects the customer's engagement and progress. Most companies have their own version of a health score, which might be custom-built according to their specific needs.

In general, the score should represent the customer's level of engagement, the milestones they've achieved (which should be data-driven), and your company's compliance with the Service Level Agreement (SLA). These factors contribute to an aggregate score that gives an overview of the customer's onboarding health. This score can be instrumental in identifying potential risks and opportunities.

The customer engagement journey: Understanding adoption through a funnel approach at ZoomInfo

In terms of customer engagement, at ZoomInfo, we view adoption as a funnel, starting from provisioning and moving down through setup, login, time to initial value, and finally, depth realization.

Provisioning

Provisioning users, or setting up their access to the system, is a critical first step in the adoption process. For instance, we've found that accounts that have 80% or more of their users provisioned within the first three months of a subscription see an 11-point lower churn rate. This finding led us to set goals related to provisioning as part of our adoption health score.

Setup

The next step is getting customers to connect their accounts to their customer relationship management (CRM) systems or other parts of their tech stack. This integration makes our product more embedded within their ecosystem, and therefore stickier. We've found that accounts that have ZoomInfo connected to other parts of their tech stack, particularly their CRM, within the first 30 days have a 20% higher likelihood of not churning.

Login

Next, we track whether users are logging into the platform, particularly during the critical first 30 days. Our data shows that if a user doesn't log in during the first 30 days, there's an 84% chance they will never log in during their subscription.

Time to initial value

This involves customers completing basic, meaningful actions within the system. Our analysis shows a 9-point lower churn rate when 80% or more of the user base performs meaningful action within the system. What's considered "meaningful" can vary across products; for us, it could be a user completing their first saved search.

Depth realization

The final stage of the adoption funnel is deep usage. Here we're looking for customers to become power users, integrating our product into multiple aspects of their work. To borrow an analogy, it's the difference between someone who just uses their iPhone to send text messages and someone who uses it in conjunction with their Apple Watch, iPad, Apple TV, and Health App.

In summary, we track each of these stages to understand our customers' progress through the adoption funnel and identify potential risks or opportunities for further engagement.

Adoption as a predictor of churn

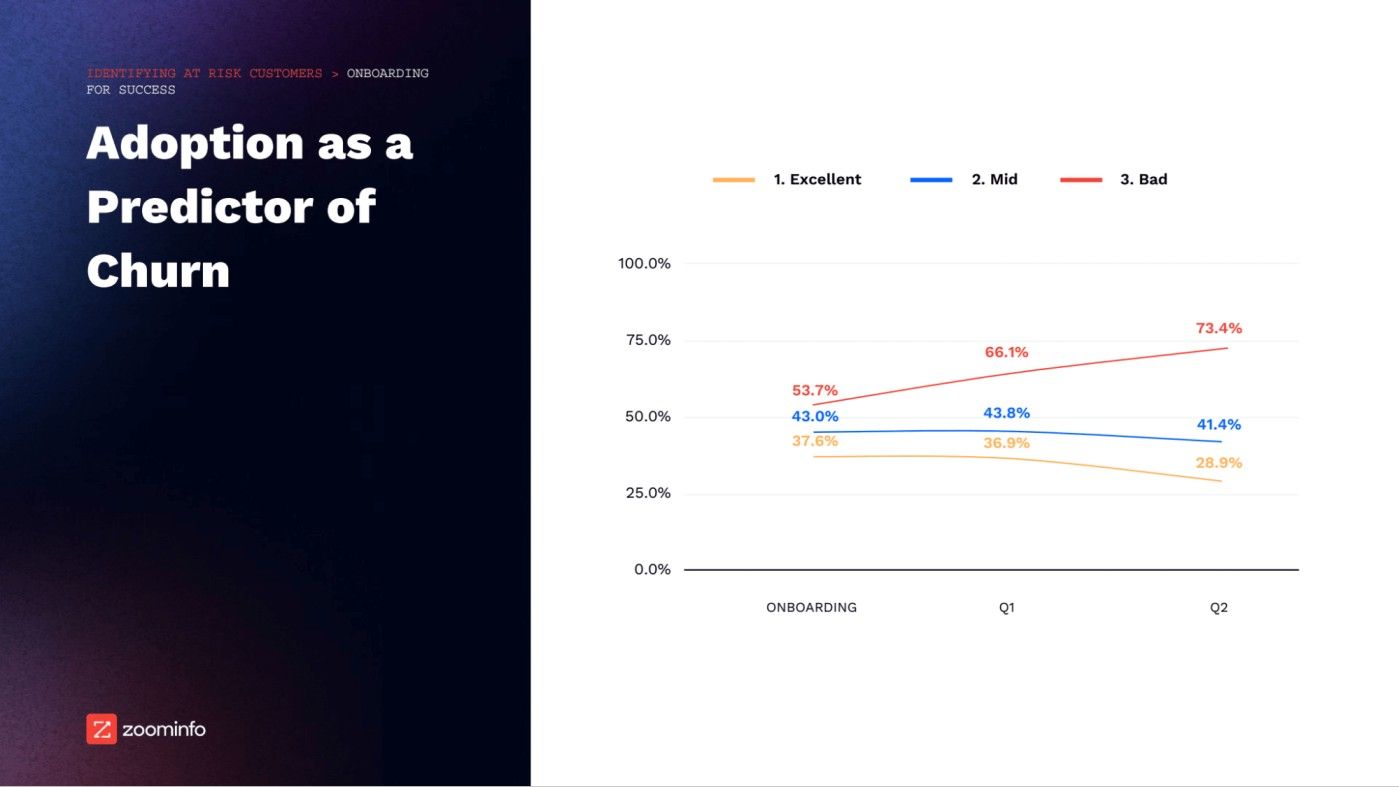

Data indicates the significant impact that early customer adoption has on churn rate. For us, we segment customer usage into different phases - onboarding Q1, Q2, and Q3.

When customers display excellent adoption statistics coming out of the onboarding phase, the likelihood to churn is 37.6%. As their usage continues to be classified as excellent through Q2 and Q3, we see the churn rate drop significantly. By Q3, with continued excellent usage, the churn rate drops to 28.9%.

On the other hand, for customers classified as having bad usage, the likelihood to churn increases over time. The difference between the two scenarios highlights the crucial role adoption plays, especially in the current economic environment. If customers don't find value in a product or aren't using it to its full potential, they're much more likely to churn.

This underscores the importance of ensuring strong early adoption, as it can significantly impact long-term customer retention. Therefore, investing resources in user onboarding and early customer success initiatives can lead to higher retention rates and a healthier business overall.

Crafting successful customer success playbooks: Strategies and tools utilized at ZoomInfo

When considering customer success playbooks, it's vital to remember that there are multiple approaches to adopt, each with its unique advantages. We've applied some of these strategies in our own practices, and while they've brought us considerable value, it's important to acknowledge that they don't constitute a comprehensive solution to every challenge we face.

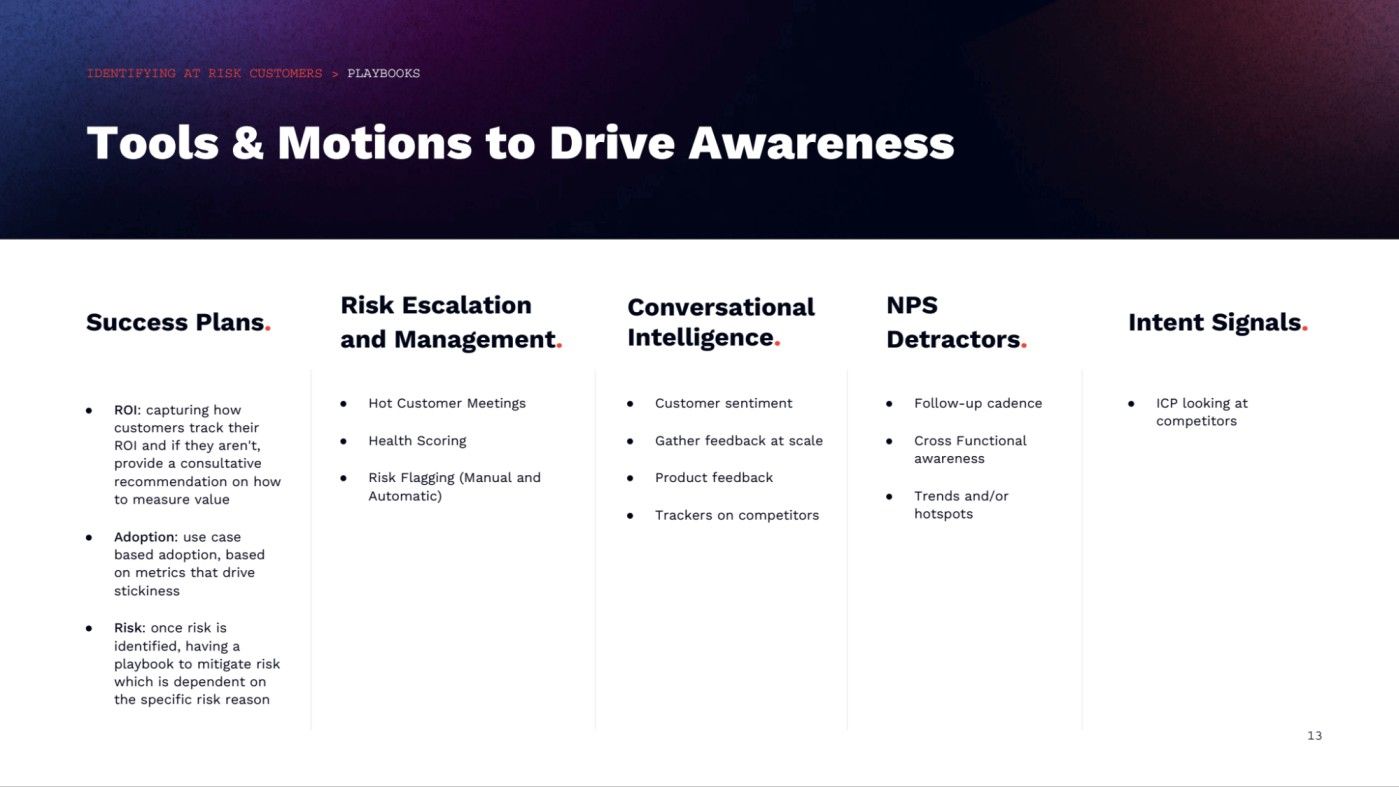

One of our main strategies revolves around success plans. We've found great value in understanding how our customers track their ROI. Whether you work with an account management (AM) team or Account Executives (AEs), developing account plans and strategies for customer adoption are critical.

We focus on use-case-based adoption driven by metrics that promote customer engagement. Understanding what matters to our customers and delivering on those aspects is essential.

Equally important is the ability to identify potential risks and have a game plan ready to address them. A method we've found useful is “swarming”, a strategy I learned about during a dinner with sales leaders from Slack. If it fits your business model, it's an effective tool to mobilize resources quickly.

We often organize what we call “hot customer meetings”, bringing together cross-functional leaders from product, CSM, support, onboarding, and sales. We swarm around our most valuable accounts, typically high-value and upmarket, focusing on areas where we need cross-functional assistance.

Health scoring is another significant strategy. We automate the process using Gainsight, which provides an adoption health score that drives our adoption funnel. It takes into account several factors, such as provisioning speed, seat utilization, and compliance with Service Level Agreements (SLAs).

If a customer has a low health score, it signals to our CSM and AM that they need to take specific actions to improve that customer's experience.

Conversational intelligence tools like Gong and Chorus can provide insightful data. They analyze hundreds of calls, tracking how many times certain features are mentioned in a negative context, or identifying trending topics in specific market segments.

For example, how many times are budget constraints or layoffs being discussed? This intelligence allows us to take appropriate actions, gather feedback at scale, and track competitor mentions.

We use a variety of methods for gathering feedback, including net promoter score (NPS), post-onboarding surveys, and periodic check-ins at the three- and six-month marks. If a customer makes a significant upsell, we conduct a pulse check to ensure they're satisfied with their decision.

Finally, intent signals have proved to be a valuable tool for us and many others in the market. These signals provide real-time alerts when our customers are exploring options that might indicate a potential churn risk or upselling opportunity.

For example, if I receive an alert that a customer is looking at a competitor's cloud optimization solutions, it signals that I should engage with them to understand their needs better and potentially provide a more suitable solution. These intent signals play a crucial role in helping us mitigate and identify risks.

Leveraging data and cross-functional feedback for effective customer onboarding and retention

Data analysis is pivotal in understanding the trends and timing of customer attrition. It's crucial to identify when and why you are losing customers. To this end, health scores can offer valuable insights about when these scores start to decline.

Is the issue more prevalent in specific product lines, or does it depend on firmographic factors, such as the size of the company? We segment our data based on the number of employees in a company, which can give us a clear view of whether a problem is more pronounced in the mid-market sector, for instance.

Tech companies, including growth tech firms, tend to be mid-market businesses. Consider companies like Toast and Snowflake; while they are hyper-growth companies, they could still experience challenges in the current market conditions.

We also consider competitive pressures. For example, a company like Salesforce may have faced much pressure in the SMB sector 15 years ago, when smaller, cheaper, and easier-to-set-up solutions started appearing in the market. These solutions might not have been as robust, but customers might have preferred them over fancier solutions that they didn't see value in.

Furthermore, cross-functional feedback is a potent tool. Sales teams, for instance, need feedback about their performance. While they usually want to do their best, they might need guidance on how to sell more effectively, like emphasizing the time it takes for onboarding, or understanding what they can realistically deliver.

Feedback also extends to the product teams. Do they understand the product's potential risks, or are they just creating without a clear purpose?

TL;DR

In conclusion, awareness is key. The onboarding and adoption phase is crucial as it is the first time you can gauge a customer's experience. An old Chinese saying – translated into English as "a good beginning is half of success" – captures this concept perfectly.

Investing time, effort, and resources into the onboarding phase is essential because it sets the tone for the rest of the customer's journey. Being aware of potential issues allows you to control them. Conversely, what you aren't aware of may end up causing significant challenges.

Learn today. Lead tomorrow.

If you enjoyed reading Dominic's insights, then why not browse our catalog of customer success courses and continue your CS education?

Whether you'd like to master retention, hone your leadership skills, or perhaps just brush up on your core CS skills, we have something for everyone, at any stage in their career.